The trend is the fundamental cornerstone of technical analysis. The trend denotes the overall direction of the market at a given time over a given scope, showing the trader the tendency of change in market prices. More simply put, the trend shows the direction of the market. Thus it follows that all trends fall under one of the following three categories: upward, downward, and sideways. Trends may also be classified by their timeframes as long-term, medium-term and short-term trends. However, any number of smaller trends can occur within larger trends.

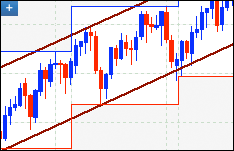

Upward Trend

An upward trend is denoted by the systematic and extended rise in the price of the given asset over some prolonged period of time. This does not mean that the price of the given asset never recedes, but merely that in the overall picture the price rises more than it falls in the given timeframe. A theoretical sketch of an uptrend is presented on the right. Downward Trend

A downward trend shares all the characteristics of the upward trend but in the reverse direction, thus denoting the fall in the price of a given asset.

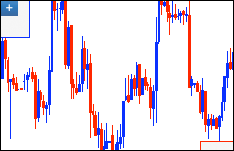

Sideways Trend

The sideways trend is also known as a trendless, ranging or flat market. Though similar to the other two types, the sideways trend shows no major difference in the price values between the beginning and the end of a specific time period. The sideways trend denotes market conditions in which prices may be moving back and forth between levels of support and resistance.

But remember, trends do not last forever. As the saying goes, ‘The trend is your friend until the end when it bends.’

The information provided in this article is for informational purposes only and should not be construed as financial, investment, or professional advice. The views expressed are those of the author and do not necessarily reflect the opinions or recommendations of any organizations or individuals mentioned. Always consult with a qualified financial advisor or other professionals before making any financial decisions. The author and publisher are not responsible for any actions taken based on the content provided.